Last Updated: January 18, 2026 at 14:30

Consolidation & Reflection: Building Your Behavioral Finance Mental Map - Behavioral Finance Series

Having come half way through the series, and after navigating the twists and turns of human bias, emotional markets, and liquidity spirals, you might be asking yourself: ‘Have I really absorbed all this? Can I actually use it?’ Take a deep breath — you’re exactly where you should be.

Why a Pause Matters

Behavioral finance isn’t just theory — it’s a practical toolkit for understanding why markets move the way they do, why investors behave irrationally, and how you can design your own guardrails.

By now, you’ve covered a lot: individual biases, emotional cycles, herd behavior, narratives, bubbles, crashes, and practical mitigation strategies. That’s a lot of new mental models. Taking a moment to consolidate helps you:

- Connect the dots between concepts

- Reinforce retention and understanding

- Build confidence that you can apply these ideas in real markets

Think of this tutorial as a mid-series checkpoint — a chance to pause, reflect, and recognize that you are developing a rare skill set: the ability to see markets as a human system, not just numbers on a screen.

Layered Mental Map of Concepts So Far

A. Individual Cognition & Biases

System 1 vs System 2 Thinking:

- System 1 is fast, intuitive, and often emotional — the part of your brain that reacts instantly.

- System 2 is slow, deliberate, and analytical — it evaluates decisions carefully. Investors often over-rely on System 1 during market swings, leading to mistakes.

Loss Aversion & Disposition Effect:

- People feel losses more intensely than equivalent gains.

- This bias leads investors to sell winners too quickly to “lock in gains” and hold losers too long to avoid admitting mistakes, distorting returns.

Overconfidence, Anchoring, Confirmation Bias, Recency Bias, Extrapolation Bias:

- Overconfidence: Overestimating knowledge or ability to predict markets.

- Anchoring: Relying too heavily on initial price points.

- Confirmation bias: Seeking information that supports existing beliefs.

- Recency & extrapolation biases: Assuming recent trends continue indefinitely. Together, these errors create systematic mispricing and poor decision-making.

B. Emotional Decision-Making

Fear and Greed Cycles:

- Markets are driven by collective emotion: greed inflates prices, fear triggers panic selling.

- These cycles amplify volatility, causing prices to overshoot or collapse faster than fundamentals justify.

Mental Accounting & Regret Aversion:

- Investors treat money in “mental buckets,” which can distort decisions (e.g., separate “fun money” vs “savings”).

- Regret aversion leads to inaction or hasty exits to avoid feeling remorse, even when data suggests otherwise.

C. Social Dynamics

Herd Behavior, FOMO, Social Proof, and Reputational Risk:

- Individuals often follow the crowd, especially in uncertain markets.

- Fear of missing out or wanting to match peers’ actions can amplify bubbles and crashes.

- Reputation concerns in professional or social settings further intensify these dynamics.

Interconnected Decisions:

- Few investment decisions occur in isolation; each choice is influenced by market chatter, news, and the visible actions of others.

- This creates feedback loops where behavior reinforces itself across the market.

D. Market-Level Patterns

Prices Overshooting Fundamentals:

- Collective psychology drives markets beyond fair value during rallies and below value during panics.

- Investor sentiment can sustain irrational pricing for extended periods.

Emotional Market Cycles:

- Markets tend to move through predictable emotional stages: optimism → euphoria → panic → hope.

- Understanding these cycles helps investors anticipate potential reversals rather than react impulsively.

Narrative Economics:

- The stories we tell ourselves about markets shape behavior.

- Booms feel justified while we’re in them, but crashes appear obvious only in hindsight — narratives give false confidence in real-time.

E. Structural and Leverage Effects

Minsky’s Financial Instability Hypothesis:

- Stability encourages risk-taking, evolving from Hedge (safe) → Speculative (interest-only) → Ponzi (dependent on rising prices) finance.

- The system becomes fragile, and when Ponzi units fail to find buyers, a sudden collapse — a “Minsky Moment” — occurs.

Liquidity Spirals & Margin Calls:

- Falling prices trigger forced sales for leveraged investors, causing further declines and more margin calls.

- This self-reinforcing cycle explains why crashes are often faster and more severe than rallies.

Structural Fragility Matters:

- Crashes aren’t just about panic — the interconnectedness of positions, leverage, and illiquid assets makes markets inherently fragile.

F. Practical Investor Toolkit

Pre-Commitment Rules, Scenario Planning, Reflective Journaling:

- Establish rules for entry, exit, and risk tolerance in advance to avoid emotional reactions.

- Plan for extreme scenarios and reflect on past decisions to improve future behavior.

Participation vs Preservation:

- Balance growth opportunities with capital protection.

- Avoid taking reckless risk, but don’t miss out on reasonable exposure to productive assets.

Risk Management Tools:

- Dynamic Hedging: Use strategies that protect during volatility (e.g., tail-risk funds, VIX options).

- Liquidity Provision: Maintain cash or assets that can be deployed in stressed markets.

- Correlation Stress-Testing: Plan for extreme cases where all asset classes move together, not independently.

Seeing It All in Action

Imagine a week in the market:

- Monday: Your favorite stock falls 5% — you notice a bit of fear in your gut (loss aversion alert).

- Tuesday: Headlines show everyone selling, and FOMO kicks in for some investors who think “I must act!”

- Wednesday: You recall the Minsky Moment discussion and margin-call mechanics — you check liquidity, confirm position sizing, and stay disciplined.

- Thursday: Experts start buying into the panic because they have planned for dislocations.

- Friday: The market stabilizes, and those with pre-commitment rules avoided overreacting.

Notice what you just did: by mentally applying the concepts you’ve learned, you behaved like a thoughtful, prepared investor — not a panicked participant. That’s the power of layering behavioral finance mental models.

Reflection Prompts for Confidence

Take a few minutes to reflect:

- Which cognitive biases are you most likely to fall prey to?

- How would you respond to a sudden market crash based on what you’ve learned?

- Where do your mental models overlap with actual market mechanics?

- Which strategies or rules could you implement immediately to protect yourself?

Writing down your answers or even thinking them through will cement the concepts in your memory and make them actionable.

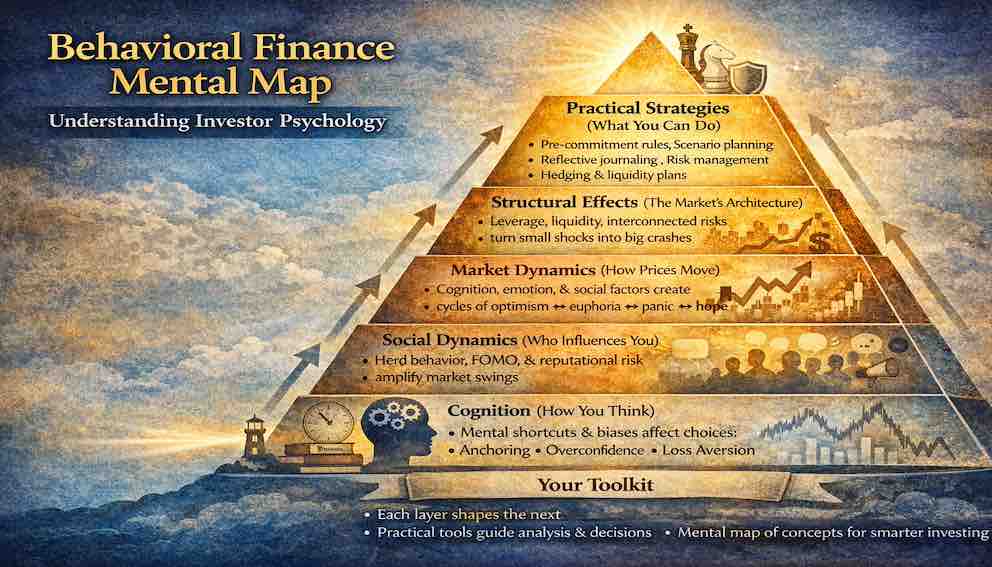

Visual Mental Map: How Behavioral Finance Fits Together

Think of behavioral finance as a multi-layered framework that helps you understand why markets move and how investors behave:

Cognition (How You Think)

- Your mental shortcuts, biases, and decision-making patterns influence every choice.

- Example: Anchoring or overconfidence can distort how you interpret market data.

Emotion (How You Feel)

- Fear, greed, and regret shape how you react to gains and losses.

- Example: Panic selling in a crash or overbuying in a euphoric rally.

Social Dynamics (Who Influences You)

- Herd behavior, FOMO, and reputational concerns amplify market swings.

- Example: Selling or buying because “everyone else is doing it.”

Market Dynamics (How Prices Move)

- Collective cognition, emotion, and social influences create cycles of optimism, euphoria, panic, and hope.

- Example: Price overshooting during bubbles, sudden crashes, or narrative-driven swings.

Structural Effects (The Market’s Architecture)

- Leverage, liquidity, and interconnected positions can turn small shocks into large crashes.

- Example: Margin calls and liquidity spirals during 2008 or 2020.

Practical Strategies (What You Can Do)

- Pre-commitment rules, scenario planning, reflective journaling, risk management, hedging, and liquidity planning.

- Example: Avoiding forced selling during panic and taking advantage of temporary dislocations.

How to Use This Mental Map:

- Each layer builds on the previous one — understanding cognition informs your emotional responses; emotions influence social behavior; together they drive market dynamics, which interact with structural factors.

- Your practical toolkit sits on top, letting you anticipate, interpret, and act rationally in real markets.

- Whenever a new concept appears in the series, you can place it in this framework, instantly seeing how it connects to what you already know.

Think of it as your behavioral finance GPS: it tells you where you are, what forces are acting on you, and how to navigate toward smarter investing decisions.

Key Takeaways

- You’re midway through a rare and powerful skill set: understanding markets through human behavior, not just numbers

- Behavioral finance is about anticipating patterns, not predicting exact outcomes

- Consolidation is crucial: mastery comes from connecting concepts, not memorizing them

- The tools you now have — bias awareness, emotional discipline, scenario planning, liquidity management — form a strong foundation for future topics.

Remember: very few investors know these frameworks. By taking the time to pause and consolidate, you are already ahead of the vast majority of the market.

✅ Reflective Prompt Before Moving On

“I have learned how cognition, emotion, social dynamics, and market structures interact. I can anticipate biases and prepare for panic, liquidity crises, and narrative-driven swings. What is the one rule or framework I can commit to today to strengthen my investing discipline?”

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.