Last Updated: February 8, 2026 at 09:30

Yield Explained: Understanding Bond Yields, YTM, and What Actually Drives Returns

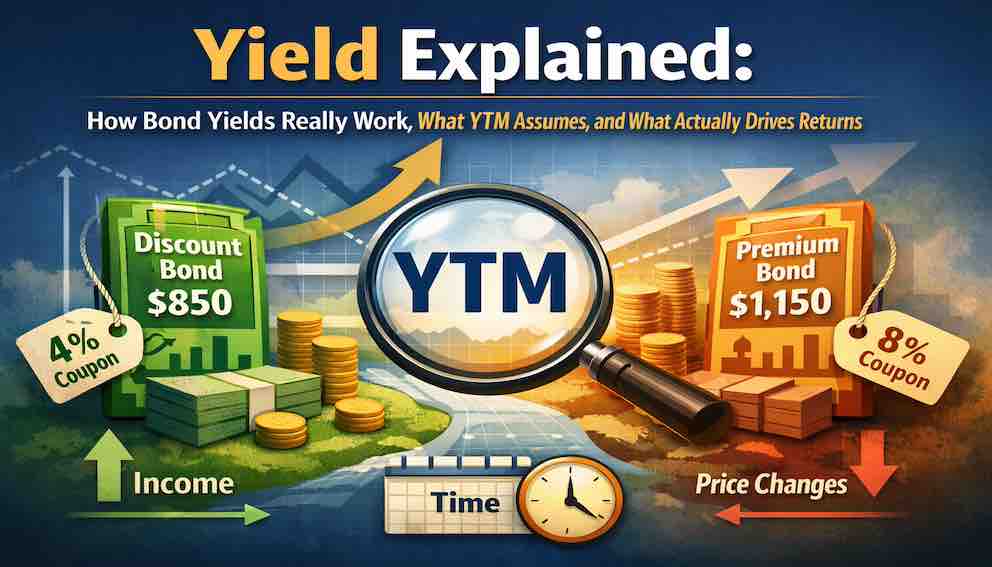

A bond’s yield is often confused with its coupon rate, but they are not the same thing. The coupon tells you how much cash the bond pays each year based on its face value, while yield tells you what return you earn on the price you actually pay today. Yield blends income, price, and time into a single number you can compare across bonds. In this tutorial, you’ll see why the coupon becomes misleading once a bond trades above or below face value, what Current Yield really tells you (and what it ignores), and why Yield to Maturity (YTM) is a useful but conditional forecast rather than a guarantee. By the end, you should be able to treat yields as comparison tools—not promises.

Introduction: Why the Coupon Stops Telling the Whole Story

In the previous tutorial, you learned that when market interest rates change, bond prices move in the opposite direction. The bond’s cash flows (its coupons and principal) do not change, but the price investors are willing to pay today does. That price adjustment brings the bond’s overall return in line with current market conditions.

However, bonds are often described by their coupon rate, which looks like an interest rate and sounds like an interest rate. The problem is that the coupon rate is always calculated on the face value (for example, 5% of 1,000), not on the market price you actually pay. The moment a bond trades away from 1,000, the coupon rate stops being a good description of your true return.

The coupon answers a narrower question than most investors realise:

“How much interest does this bond pay each year, as a percentage of its face value?”

It does not answer:

“Given the price I’m paying today, what return am I earning over time?”

To see why this matters, consider two bonds from the same issuer, each with 10 years left:

Bond A (currently a discount bond)

- Price today: 850

- Coupon rate: 4% → pays 40 per year

Bond B (currently a premium bond)

- Price today: 1,150

- Coupon rate: 8% → pays 80 per year

At first glance, Bond B looks “better” because 8% is bigger than 4%. But you are paying much more for Bond B than for Bond A. One is cheap, one is expensive. You need a way to compare them that takes into account income, price, and time. That common language is yield.

Yield as the Market’s Language of Return

Yield exists because the market needs a single number to describe return when prices are different but the basic idea of a bond (pay coupons, repay principal) is the same.

Key points about yield:

- It is not set once at issuance and left there forever.

- It is implied by today’s market price and the bond’s promised cash flows.

- When prices move, yields move in the opposite direction, even though the bond’s cash flows have not changed.

At its core, yield tries to compress three elements into one number:

- The cash flows the bond promises to pay (coupons and principal).

- The price an investor pays today.

- The time pattern of when those payments arrive.

Different yield measures answer different questions. Some focus mainly on “How much income am I getting this year?” Others try to answer “If everything goes as planned until maturity, what average annual return will I earn?” Understanding yield is therefore about knowing:

- Which question a yield measure is answering.

- What it leaves out.

Part 1: Current Yield — A Helpful but Incomplete Snapshot

The simplest yield measure is Current Yield. It asks:

“How much annual income am I getting, relative to the price I’m paying today?”

The formula is:

Current Yield = Annual Coupon Payment / Current Market Price

Assume both bonds have a face value of 1,000.

Bond A

- Coupon: 4% of 1,000 = 40 per year

- Price: 850

- Current Yield ≈ 40 ÷ 850 ≈ 4.7%

Bond B

- Coupon: 8% of 1,000 = 80 per year

- Price: 1,150

- Current Yield ≈ 80 ÷ 1,150 ≈ 7.0%

What has Current Yield done for us?

- It has fixed the main flaw in the coupon rate by using the price you actually pay, not just the face value.

- It shows correctly that Bond B gives you more income this year for each dollar of price you pay.

But it has a serious limitation: Current Yield ignores what happens at maturity.

- Bond A: You pay 850 now and get 1,000 back at maturity → a 150 gain.

- Bond B: You pay 1,150 now and get 1,000 back at maturity → a 150 loss.

Current Yield acts as if these gains and losses don’t exist. It focuses only on today’s income, not on how the story ends. That’s why it’s best to treat Current Yield as:

A snapshot of income, not a full measure of total return.

Part 2: Yield to Maturity — The “Full Journey” Return (Under Assumptions)

Yield to Maturity (YTM) is designed to answer a much bigger question:

“If I buy this bond at today’s price, hold it until it matures, receive all coupons as scheduled, and reinvest those coupons at the same rate, what average annual return will I earn?”

YTM combines:

- The income from coupon payments, and

- The price change as the bond’s market price converges toward its face value by maturity.

In technical terms, YTM is the discount rate that makes the present value of all future cash flows equal to the bond’s current price. Conceptually, it’s just an “internal rate of return” for a bond.

Suppose the market prices both of our bonds so that each has a YTM of 6%.

Bond A (discount)

- Low coupon (40), but bought at 850.

- You earn some return from income, and a significant return from the 150 gain when the price moves from 850 toward 1,000 by maturity.

Bond B (premium)

- High coupon (80), but bought at 1,150.

- You earn a lot of income, but some of that income is offset by the 150 loss as the price drifts down from 1,150 to 1,000.

The paths are very different, but under YTM’s assumptions, both combinations work out to the same average annual return of 6%.

A zero‑coupon bond makes this logic crystal clear: A zero‑coupon bond has no coupons at all, so its entire yield comes from the difference between a low purchase price today and face value at maturity. YTM is always about how the whole cash flow pattern relates to today’s price.

Decomposing Total Return: Income, Price, Timing

You can think of total return as having three components:

Income from coupons.

Price change between what you pay and what you get back at maturity.

Timing of when these cash flows arrive.

- For a discount bond like Bond A, return = modest income + price gain.

- For a premium bond like Bond B, return = high income + price loss.

YTM compresses all of this into one annualised number. That’s powerful for comparison—but it also hides important details. Two bonds can have the same YTM but:

- Pay very different amounts of income each year.

- Expose you to different reinvestment risk (how much coupon cash you must reinvest).

- Behave differently if rates move before you reach maturity.

Part 3: The Fine Print of YTM — Three Big Assumptions

YTM is not a promise; it is a what‑if scenario. It depends on three key assumptions:

Reinvestment at the same yield

YTM assumes every coupon you receive can be reinvested at the same rate as the YTM itself.

- If future rates are lower, your actual return will be less than YTM.

- If future rates are higher, your actual return can be more than YTM.

- This assumption matters most for high‑coupon bonds, where a lot of cash comes back early and must be reinvested.

Holding the bond to maturity

YTM assumes you keep the bond until it matures. If you sell earlier, your actual return depends on the price at that time, which could be higher or lower than the path implied by YTM.

No default (all payments are made)

YTM assumes the issuer pays every coupon and repays principal in full and on time. In risky bonds, higher YTM partly compensates for the chance of default—but if default happens, the whole YTM calculation breaks.

These are not defects. They simply define the conditions under which YTM answers its question.

Part 4: Same YTM, Different Reality — Why the Journey Matters

Now imagine two investors, each with a 10‑year horizon.

Investor 1: Buys the discount bond (Bond A)

- Pays 850.

- Receives modest income: 40 per year.

- Gains 150 at maturity when the bond pays back 1,000.

- Faces less reinvestment risk (not much coupon cash to reinvest).

- Faces more price volatility along the way, because a bigger share of total value is in the final payoff.

Investor 2: Buys the premium bond (Bond B)

- Pays 1,150.

- Receives generous income: 80 per year.

- Loses 150 at maturity when the bond pays back only 1,000.

- Faces more reinvestment risk, because those larger coupons must be reinvested repeatedly.

- May see different price behaviour along the way, since more of the bond’s value is coming back early in cash.

Both bonds can have the same YTM, but the experience of holding them is very different. YTM equalises the expected return under strict assumptions, but it does not equalise:

- Cash flow timing.

- Reinvestment exposure.

- Interim price volatility.

For students, the key lesson is: “same YTM” does not mean “same risk” or “same journey.”

Part 5: Using Yield in Practice — A Simple Decoder

When you look at a bond (or a bond fund), you can decode yield step by step.

Check the bond’s price vs. face value.

- Discount bond (price < face) → part of your return comes from a capital gain at maturity.

- Premium bond (price > face) → part of your coupon income is offset by a capital loss at maturity.

Compare coupon rate and YTM.

- If YTM > coupon rate, the bond trades at a discount.

- If YTM < coupon rate, the bond trades at a premium.

- If YTM = coupon rate, the bond trades at par.

Ask whether the assumptions fit you.

- Will you realistically hold this bond to maturity, or might you need to sell earlier?

- Does your investment horizon match the bond’s maturity?

- How much coupon cash will you receive, and are you comfortable with the reinvestment risk that brings?

- Does the cash flow pattern (steady high income vs. lower income and a lump‑sum gain) fit your needs?

Seen this way, yield becomes a tool for structured thinking, not just a number on a factsheet.

Conclusion: Yield as a Compass, Not a Promise

In this tutorial, you moved from thinking “coupon = return” to a more accurate picture:

- The coupon rate is about what the bond pays relative to face value, not what you earn on the price you pay.

- Current Yield improves on the coupon by using market price, but it only describes today’s income and ignores gains or losses at maturity.

- Yield to Maturity combines income, price change, and time into one annualised figure, under clear assumptions about reinvestment, holding to maturity, and no default.

- Two bonds with the same YTM can still behave very differently and feel very different to hold.

The central insight is simple but powerful:

Yield is not a guarantee. It is the market’s best attempt to describe expected return under idealised conditions.

If you treat yield as a compass—a way to compare opportunities and understand trade‑offs—rather than as a fixed promise, it becomes one of the most useful concepts in bond investing. In the next tutorial, we’ll build on this by introducing Duration, the standard measure of how sensitive a bond’s price is to changes in interest rates.

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.