Last Updated: February 11, 2026 at 18:30

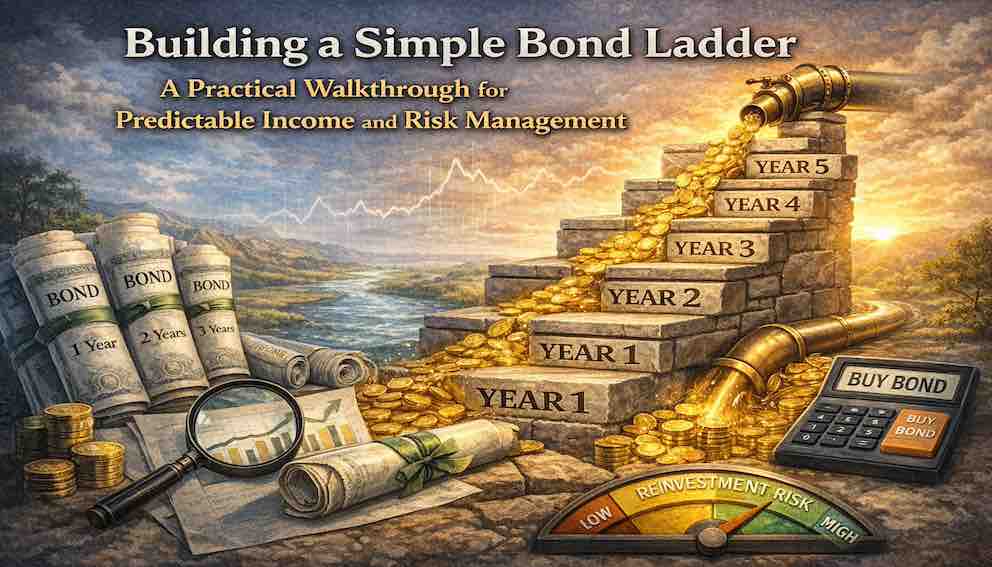

Building a Simple Bond Ladder: A Practical Walkthrough for Predictable Income and Risk Management

Creating a bond ladder is one of the most effective ways to manage cash flow, reinvestment risk, and interest rate uncertainty without trying to predict the market. This tutorial walks you through a practical, step-by-step approach to constructing a bond ladder tailored to a real investor profile. You will see how staggering maturities provides predictable income, simplifies reinvestment decisions, and reduces overall portfolio risk. By following a disciplined schedule rather than chasing market timing, investors can create a reliable framework for income planning and long-term financial stability.

Introduction: Building Your Personal Financial Pipeline

Throughout this series, we have explored bonds as tools for shaping a portfolio’s stability, income, and risk profile. Now, we arrive at one of the most empowering applications of that knowledge: the bond ladder.

Think of a bond ladder as a network of wells feeding a pipeline of cash into your life. You could try to guess the weather, hoping to capture rain only during storms—this is like trying to predict interest rates. Or, you could dig a series of connected wells at different depths, so that as one runs dry, another begins flowing. That is exactly what a bond ladder does: it provides a structured, predictable flow of income, systematically reducing the stress of reinvestment and the uncertainty of interest rate movements.

The ladder transforms a lump sum of capital into a self-sustaining income engine, and this tutorial will teach you how to build it step by step.

Step 1: Define Your Investment Goals for Your Bond Ladder

Before constructing your ladder, it is essential to be clear about your objectives, liquidity needs, and risk tolerance. Consider these questions:

- How much cash flow do you need annually?

- How much capital can you allocate to bonds?

- What level of credit or default risk are you willing to accept?

- Over what period do you want your ladder to operate?

For example, our investor, Jane, has $100,000 from an inheritance. She wants safe, supplementary income and access to a portion of the principal each year without having to sell bonds at unfavorable prices. Her goal emphasizes capital preservation with predictable liquidity, which shapes the ladder design.

Step 2: Choose Ladder Length and Maturity Intervals

The ladder length defines the total time span of your ladder, while the maturity intervals determine how often cash flows are received. Common approaches include:

- Short-term ladder: 3–5 years

- Medium-term ladder: 5–10 years

- Long-term ladder: 10–20 years

Intervals can be annual, semi-annual, or quarterly, depending on your income needs. For Jane, a 5-year ladder with annual maturities is ideal: simple to manage, provides steady cash flow, and turns over quickly enough to reinvest at current rates.

Step 3: Select Bonds for Each Rung of Your Ladder

Choosing the right bonds is key. Here are critical considerations:

- Credit quality: Treasuries and AAA-rated corporates reduce default risk.

- Coupon type: Fixed coupons provide predictable income; floating-rate bonds adjust with interest rates.

- Callable vs. non-callable: Callable bonds may be redeemed early, disrupting the ladder. Non-callable bonds are safer for a structured plan.

- Liquidity: Ensure bonds can be bought and sold without large discounts.

For Jane, the ladder is built with a barbell strategy:

- Rung 1 (1-year): Ultra-safe Treasury bill or high-quality CD for immediate liquidity.

- Rungs 2 & 3 (2–3 years): Short-term Treasury notes or AAA-rated CDs, slightly higher yield.

- Rungs 4 & 5 (4–5 years): High-quality corporate or agency bonds, adding yield while maintaining safety.

This design balances liquidity, safety, and yield, giving her a smooth cash flow without taking unnecessary risk.

Step 4: Allocate Capital Across Rungs (Alternative to Table)

- Year 1 (Rung 1): $20,000 – Treasury bill / liquid cash-equivalent

- Year 2 (Rung 2): $20,000 – Short-term Treasury or AAA CD

- Year 3 (Rung 3): $20,000 – Short-term Treasury or AAA CD

- Year 4 (Rung 4): $20,000 – Corporate bond / agency bond

- Year 5 (Rung 5): $20,000 – Corporate bond / agency bond

Step 5: Execute the Ladder – Buying the Bonds

Once bonds are chosen and capital allocated, purchase them according to your plan. Jane buys her bonds, each assigned to a specific rung, ensuring that cash flows will begin to arrive on a predetermined schedule.

- Year 1: $20,000 bond matures → cash available for spending or reinvestment

- Year 2: $20,000 bond matures → same

- …through Year 5

The staggered maturities create a predictable rhythm, which is the heart of ladder investing.

Step 6: Reinvesting the Matured Bonds – The Roll

The ladder works best when matured bonds are systematically reinvested at the far end of the ladder. This process, known as the roll, maintains the ladder’s structure over time.

Example of Jane’s first-year roll:

- Year 1 Rung 1 matures → $20,000 principal received

- Planned cash usage → $5,000

- Remaining principal to reinvest → $15,000 into a new 5-year bond (new Rung 5)

- Ladder shifts forward → Old Rung 2 becomes new Rung 1, and so on

Benefits of the roll:

- Discipline: Reinvesting a fraction of total capital avoids emotional reactions to market swings.

- Reinvestment risk management: Only a portion of capital is exposed at current rates.

- Automation of timing: You don’t guess interest rates; the system handles it.

This is the “engine” of the bond ladder—a mechanical, predictable process that turns a static portfolio into a living, self-adjusting system.

Step 7: Multi-Year Cash Flow Illustration

Here’s a walkthrough of Jane’s first five years to show cash flow and reinvestment:

- Year 1: $20,000 matures → spend $5,000, reinvest $15,000

- Year 2: $20,000 matures (previous Rung 2) → spend $5,000, reinvest $15,000

- Year 3: $20,000 matures (previous Rung 3) → spend $5,000, reinvest $15,000

- Year 4: $20,000 matures (previous Rung 4) → spend $5,000, reinvest $15,000

- Year 5: $20,000 matures (previous Rung 5) → spend $5,000, reinvest $15,000

Over time, the ladder continues rolling forward, maintaining predictable income while gradually adapting to prevailing interest rates. Each rung contributes to liquidity, yield, and safety without requiring Jane to guess the market.

Step 8: Monitoring and Adjusting Your Ladder

While the ladder is structured, it is not entirely “set-and-forget.” Key monitoring actions:

- Credit quality checks: Replace downgraded bonds to maintain safety.

- Market awareness: Observe prevailing interest rates for informed reinvestment decisions.

- Portfolio adjustments: If income needs or capital change, adjust rung amounts or add new rungs.

- Coupon and callable monitoring: Ensure reinvested bonds are fixed-rate and non-callable unless a specific strategy calls for otherwise.

Periodic review ensures the ladder continues to meet your objectives while remaining resilient to market changes.

Step 9: Advanced Considerations

The basic ladder can be adapted for special circumstances:

- Retirees seeking tax efficiency: Use municipal bonds with quarterly maturities to match expenses.

- Inflation-conscious investors: Include TIPS every other rung to protect against CPI changes.

- Low-rate environments: Consider a “barbell” ladder with very short-term and long-term bonds, skipping the middle, to optimize yield opportunities while minimizing low-intermediate exposure.

These adaptations allow investors to customize the ladder without changing the fundamental principles of staggered maturities and systematic reinvestment.

Conclusion: The Ladder as a Personal Pension

Constructing a bond ladder is a discipline-driven act of financial engineering. It transforms abstract fixed-income concepts—duration, credit risk, yield—into a tangible, reliable system for your personal financial future.

The ultimate mental model is this: a bond ladder is a personal, DIY pension plan. It provides predictable income and capital preservation while keeping you in full control.

- You are not betting on interest rates.

- You are building a system that works regardless of market direction.

- You are creating a rhythm of cash flows that reduces stress and enhances predictability.

In short, the ladder embodies the principle that structure beats prediction. By combining careful planning, disciplined execution, and systematic reinvestment, investors like Jane can achieve steady income, reduced risk, and peace of mind.

About Swati Sharma

Lead Editor at MyEyze, Economist & Finance Research WriterSwati Sharma is an economist with a Bachelor’s degree in Economics (Honours), CIPD Level 5 certification, and an MBA, and over 18 years of experience across management consulting, investment, and technology organizations. She specializes in research-driven financial education, focusing on economics, markets, and investor behavior, with a passion for making complex financial concepts clear, accurate, and accessible to a broad audience.

Disclaimer

This article is for educational purposes only and should not be interpreted as financial advice. Readers should consult a qualified financial professional before making investment decisions. Assistance from AI-powered generative tools was taken to format and improve language flow. While we strive for accuracy, this content may contain errors or omissions and should be independently verified.